Exports

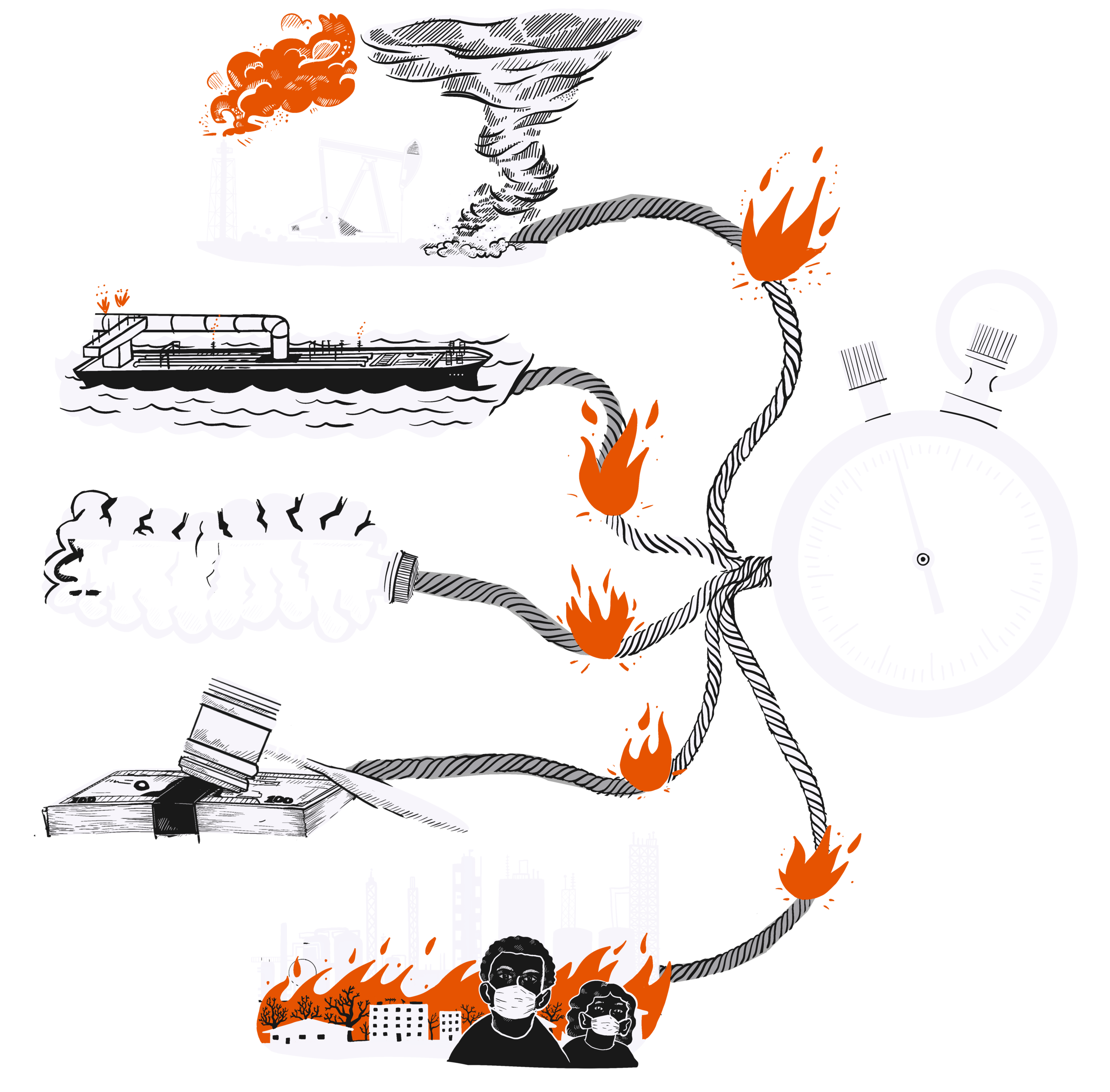

“Every incremental hydrocarbon produced [in the Permian Basin] from this day forward — whether it’s oil, liquids or gas, needs to be exported.” The LNG executive that made this statement was not wrong. In 2020, over 28% of U.S. crude oil production was exported, with the vast majority of those exports coming from the Permian. That figure was 4% before crude oil export restrictions were lifted in 2015. The explosive growth in the Permian Basin simply could not have happened if the export ban had not been lifted, as U.S. refineries simply couldn’t have absorbed all the oil.

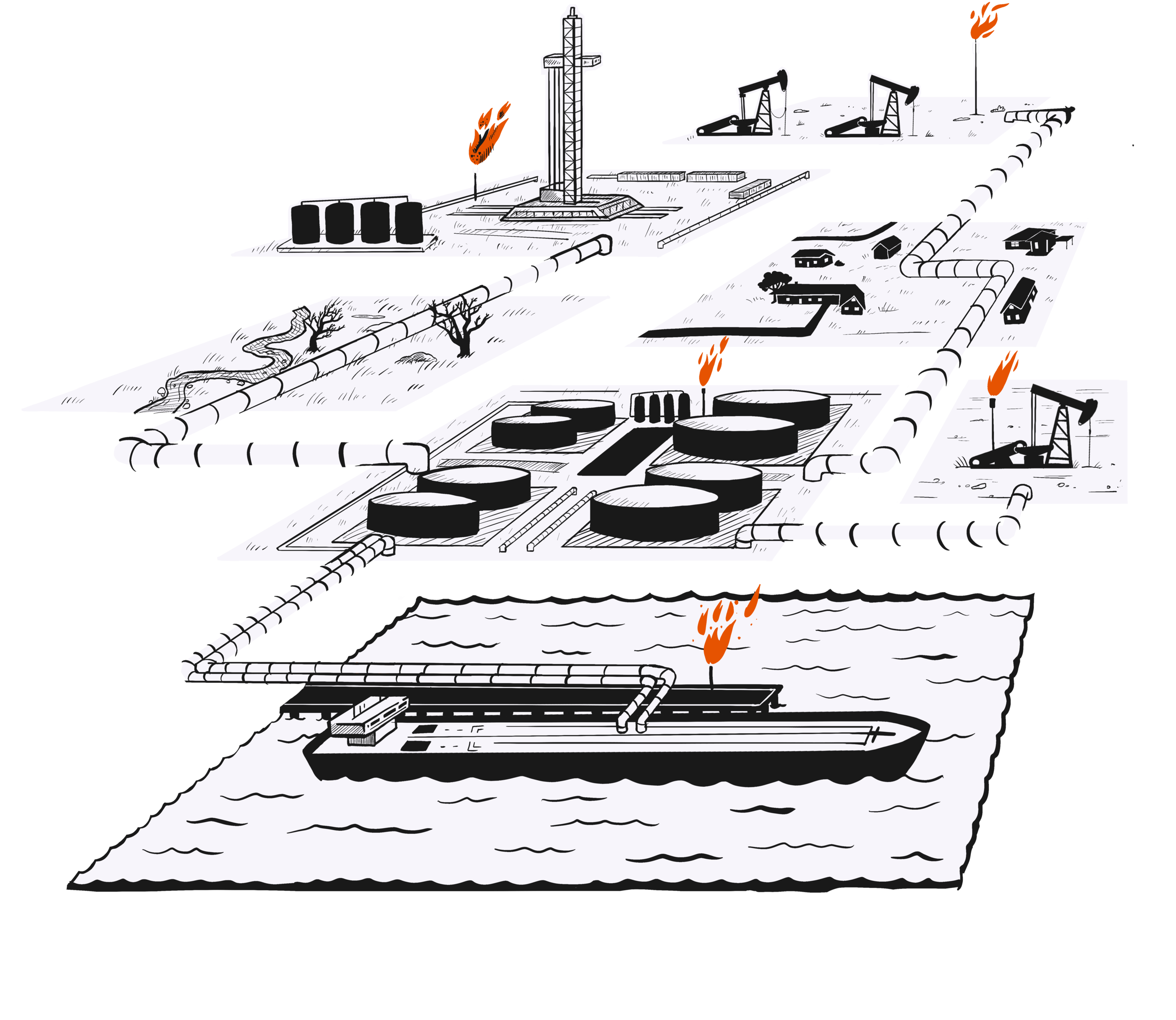

Likewise, the surging gas production that has accompanied Permian oil drilling has exceeded U.S. demand. As a result, a massive number of LNG processing and export facilities are planned for the U.S. Gulf Coast.

While gas liquids are generally processed in the U.S., exports of propane and ethane have soared, along with the raw materials feeding the plastics boom.

These three different hydrocarbons each require different pipelines to move them from the Permian Basin to export facilities on the Gulf Coast. This has led to an unprecedented build-out of pipelines in recent years, as well as a vast amount of processing plants and other industrial infrastructure. Yet more are planned.